The Ultimate Guide To Dubai Company Expert Services

Wiki Article

What Does Dubai Company Expert Services Mean?

Table of ContentsThe smart Trick of Dubai Company Expert Services That Nobody is Talking AboutMore About Dubai Company Expert ServicesThe Main Principles Of Dubai Company Expert Services How Dubai Company Expert Services can Save You Time, Stress, and Money.Dubai Company Expert Services for DummiesDubai Company Expert Services Things To Know Before You Buy4 Easy Facts About Dubai Company Expert Services Explained

The revenue tax obligation rate is 0-17%. The personal income tax price is also reduced as contrasted to other countries. The personal income tax obligation rate is 0-20%. One of the greatest benefits of signing up a business in Singapore is that you are not called for to pay tax obligations on capital gains. Dividends are likewise tax-free below.

It is simple to start service from Singapore to throughout the globe.

The startups identified through the Startup India effort are offered ample benefits for starting their very own business in India. According to the Startup India Activity strategy, the followings conditions have to be fulfilled in order to be qualified as Startup: Being incorporated or signed up in India approximately one decade from its date of consolidation.

Getting My Dubai Company Expert Services To Work

100 crore. The government of India has actually introduced a mobile application and a internet site for easy registration for start-ups. Any person thinking about establishing a startup can fill a on the website as well as upload specific documents. The entire process is entirely online. The federal government likewise provides checklists of facilitators of licenses and also hallmarks.The government will certainly bear all facilitator fees as well as the startup will bear only the legal costs. They will certainly take pleasure in 80% A is set-up by government to offer funds to the startups as equity capital. The government is also providing assurance to the lending institutions to urge financial institutions and also various other monetary organizations for giving financial backing.

This will aid startups to draw in even more financiers. After this strategy, the start-ups will have a choice to choose in between the VCs, giving them the liberty to pick their investors. In case of exit A start-up can shut its service within 90 days from the date of application of ending up The government has suggested to hold 2 start-up fests annually both nationally and also worldwide to make it possible for the different stakeholders of a startup to fulfill.

The 5-Minute Rule for Dubai Company Expert Services

Restricted firms can be a wonderful choice for numerous home financiers yet they're not best for everybody. Some property managers may in fact be much better off owning property in their individual name. We'll cover the benefits and drawbacks of limited companies, to help you choose if a limited business is the right choice for your property investment service.As a business director, you have the versatility to pick what to do with the revenues. You can purchase more properties, conserve right into a tax-efficient pension or pay the revenue tactically utilizing dividends. This versatility can aid with your personal tax preparation contrasted to directly had buildings. You can check out much more about tax obligation for home capitalists in our expert-authored overview, Intro to Building Tax Obligation.

:max_bytes(150000):strip_icc()/startup-53e4843c1edb49dd99492d4cc9802e83.jpg)

If your earnings are going up, this is certainly something you ought to keep a close eye on and also you might desire to think about a limited firm. Dubai Company Expert Services. As a director of a firm, you'll lawfully be required to keep exact business and monetary records and also discover here submit the proper accounts as well as returns to Firms House as well as HMRC.

Some Ideas on Dubai Company Expert Services You Should Know

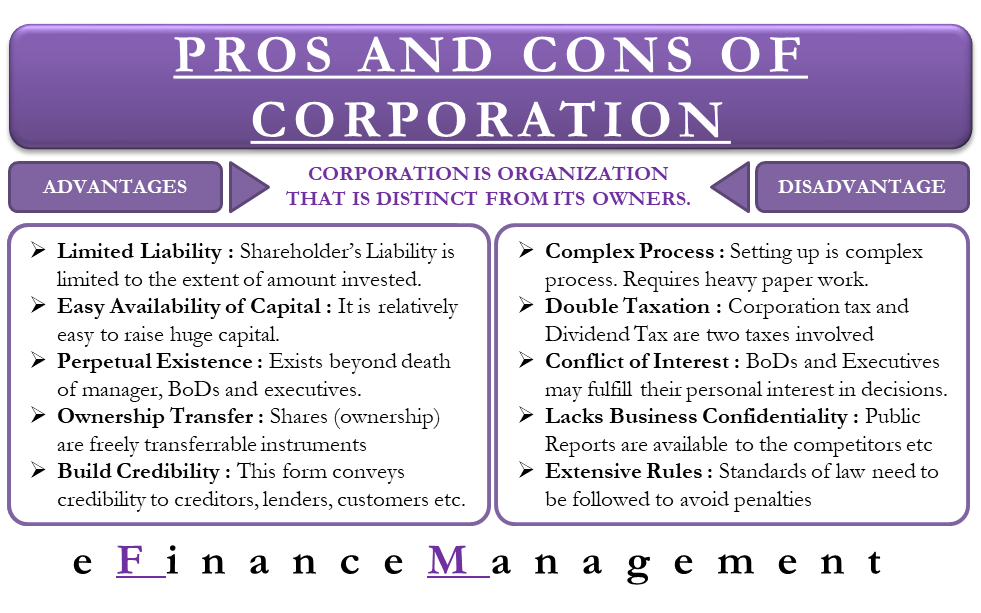

That's exactly what we do right here at Provestor: we're a You'll require to budget plan around 1000 a year for a limited company accountant and also make certain that the tax obligation benefits of a minimal company outweigh this additional cost. Something that not many individuals discuss is double tax. In a limited firm, you pay firm tax on your revenues. Dubai Company Expert Services.It deserves discovering a professional restricted company mortgage broker who can discover the very best bargain for you. On the whole, there's quite a great deal to think about. There are lots of benefits yet also additional expenses as well as even more intricacy. Crunch the numbers or conversation to a professional to make certain that the tax cost savings outweigh the additional prices of a restricted company.

An exclusive restricted firm is a type of business that has restricted obligation as well as shares that are not openly transferable. The proprietors' or participants' possessions are therefore secured in case of organization failure. Still, it needs to be stressed, this security just uses to their shareholdings - any kind of cash owed by the service stays.

Get This Report on Dubai Company Expert Services

One significant disadvantage for new companies is that setting up an exclusive minimal business can be complicated as well as expensive. To safeguard themselves from liability, business have to abide by particular formalities when incorporating, consisting of filing posts of association with Business Home within 14 days of incorporation and also the annual confirmation declaration.

The most common are Sole Investor, Collaboration, and also Private Restricted Firm. There are lots of benefits of an exclusive restricted firm, so it is the most popular option. Right here we will be talking about the benefits of a Personal Limited Company. Limited Liability The most considerable advantage of an exclusive restricted business is that the proprietors have actually limited obligation.

If the company goes insolvent, the proprietors are only accountable for the quantity they have bought the firm. Any type of firm's cash continues to be with the firm and does not drop on the owners' shoulders. This can be Get More Information a significant benefit for new organizations as it safeguards their properties from prospective company failings.

See This Report about Dubai Company Expert Services

Tax Reliable Exclusive minimal firms are tax obligation effective as they can declare company tax obligation alleviation on their revenues. This can be a substantial conserving for services and boost profits. On top of that, private restricted firms can pay dividends to their investors, which are additionally strained at a reduced rate. Furthermore, there are a number of other tax advantages offered to business, such as funding allowances and also R&D tax credit ratings.

This indicates that the company can acquire with other organizations and individuals and is accountable for its see debts. The only money that can be asserted straight in the company's commitments and not those incurred by its owners on part of the business is shareholders.

This can be helpful for small companies that do not have the time or resources to take care of all the management tasks themselves. Flexible Monitoring Structure Private restricted business are famous for sole traders or local business that do not have the sources to establish a public limited business. This can be advantageous for companies that intend to keep control of their procedures within a small group of people.

Examine This Report on Dubai Company Expert Services

This is due to the fact that exclusive minimal business are a lot more trustworthy as well as recognized than sole traders or collaborations. Additionally, private restricted companies frequently have their website and letterhead, offering clients and distributors a feeling of trust in business. Security From Creditors As mentioned previously, among the essential benefits of a private restricted company is that it offers defense from creditors.If the company goes right into debt or insolvency, financial institutions can not look for direct settlement from the personal properties of business's owners. This can be vital protection for the investors and supervisors as it limits their obligation. This means that if the firm goes bankrupt, the proprietors are not personally accountable for any money owed by the firm.

Report this wiki page